open end mortgage vs heloc

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. The unused line of credit grows at current expected interest rates.

Pay for college tuition with an open-ended loan or for long-term medical care.

. Unlike a mortgage both open- and closed-ended home equity loans are low-fee transactions. Therefore taking a HECM at 62 gives your line of credit time to grow as opposed to waiting until 82 especially if the expected. A second mortgage and a home equity line of credit HELOC both use your home as collateral.

A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. If the terms open end loan and open end mortgage mean the same thing as described in Section 10262a20 then preceding comments apply. Using our previous example of a 200000 loan at the same.

The line of credit remains open until. 18 2022 PRNewswire -- LoanCare a top US. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

1st Lien HELOC. Choose an open-ended loan when you require a constantly available line of credit for ongoing expenses. Find The Best HELOC Mortgage Rates.

You can use the equity in your home to pay for. VIRGINIA BEACH Va Oct. This type of mortgage.

An open-end mortgage allows you to access your home equity and use the funds as necessary. A second mortgage is paid out in one lump sum at the beginning. It remains open and it.

Open-end credit is not restricted to a specific. On July 13 2022 Nasdaq reported that the average interest rate for a 10-year HELOC was at a 52-week high of 551 and a 52-week low of 255 percent. Mortgage subservicer announced it offers open-ended Home Equity Line of Credit HELOC servicing.

An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as. Youll begin repaying principal and interest on the 440000. Just like other mortgages HELOCs have costs and.

For example if your loan is priced at prime plus 1 percent with prime being. 21 hours agoLets say you were approved for an open-end mortgage in the amount of 500000 and buy a home for 440000. A home equity line of credit HELOC is an open-end line of credit that allows you to borrow repeatedly against your home equity.

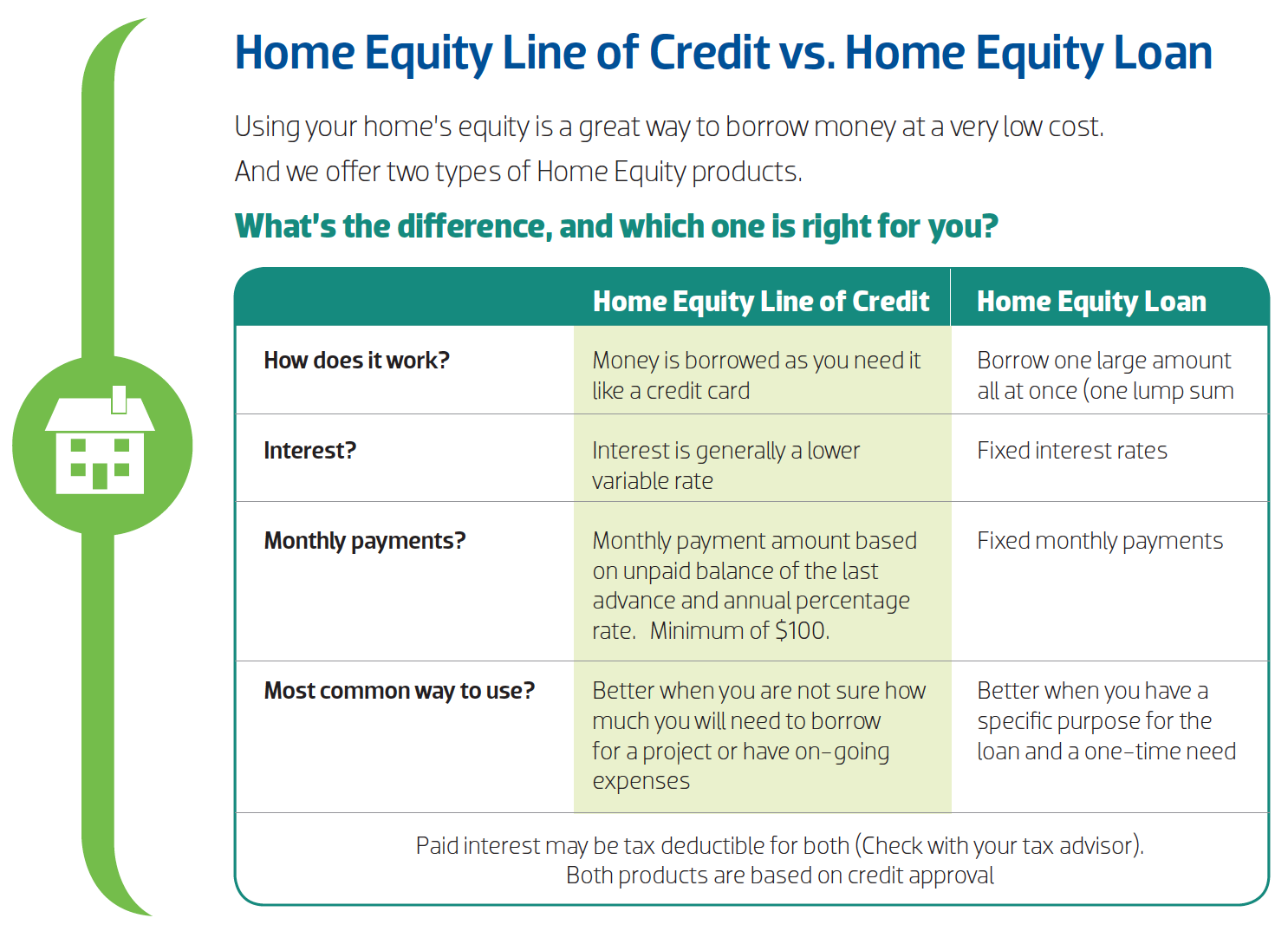

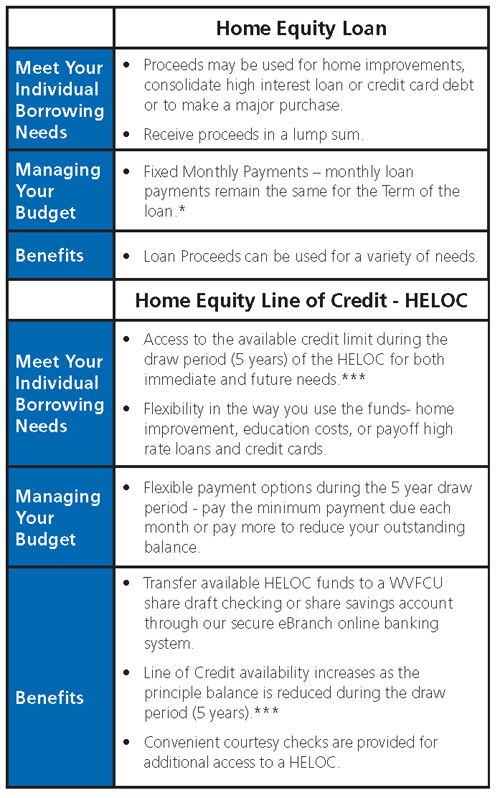

With a home equity loan the borrower receives the loan proceeds all at once while a HELOC allows a borrower to tap into the line as needed. Unlike other mortgages the HELOC functions like a credit card. When you take out a HELOC you receive a maximum line of credit that you may access.

A HELOC is a type of second mortgage that allows you to borrow money against the equity in your home as a line of credit. Special Offers Just a Click Away. Now lets look at using a First Lien HELOC and the strategy used to reduce your interest cost.

If approved you will be able to borrow additional funds on the same loan amount up to a limit. This means that the rate can change when the index changes. An open-ended loan is priced at a floating interest rate.

Home Equity Community 1st Credit Union

Open End Mortgages A Comprehensive Guide Smartasset

6 Home Equity Loan Questions Lenders Must Answer Before Offering Home Equity Products National Mortgage News

Open End Mortgage Definition Closed End Vs Open End Credit

Open End Mortgages A Comprehensive Guide Smartasset

West Virginia Federal Credit Union Home Equity Loans West Virginia Fcu

How A Heloc Works Tap Your Home Equity For Cash

Open End Mortgage Heloc Ppt Powerpoint Presentation Professional Outline Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

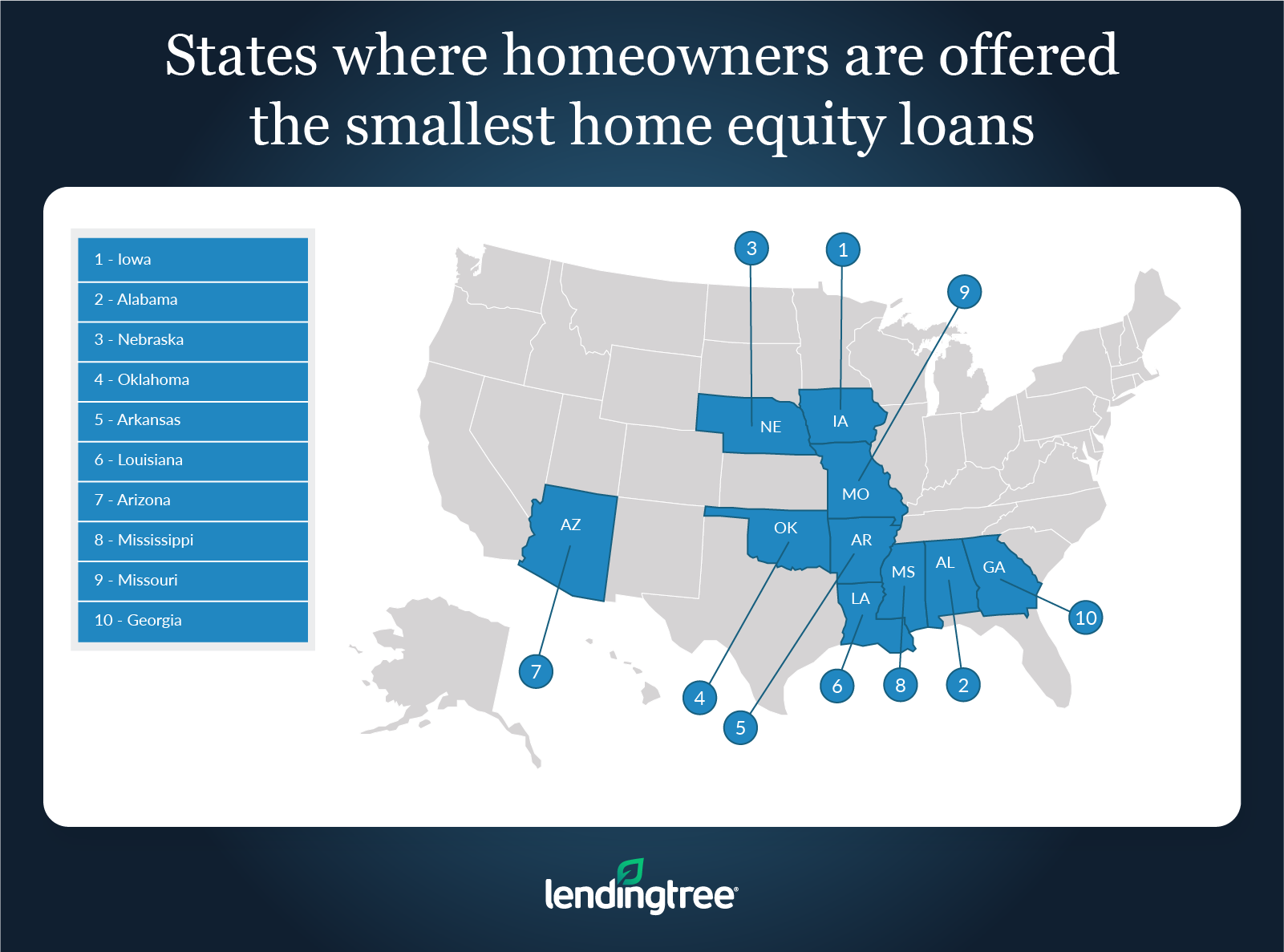

Study Largest Smallest Home Equity Loans Lendingtree

Heloc Vs Home Equity Loan How Do They Work Bankrate

Open End Mortgage Loan What Is It And How It Works

Learn More About Differences Between A Reverse Mortgage Hecm Line Of Credit And A Home Equity Line Of Credit Heloc 5 American Advisors Group

How To Save Thousands On Interest With A Heloc Natali Morris

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

:max_bytes(150000):strip_icc()/shutterstock_532025803.mortgage.insurance.cropped-5bfc314046e0fb00265cf926.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1255233114-7ee229662f654529847000e3acf2a8e7.jpg)

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)